Amazon Prime Day Loses Its Catalyst Effect

Shift in Investor Focus to AWS

Amazon’s annual Prime Day, once a major driver for the company’s stock, no longer holds the same significance for investors as e-commerce takes a backseat to Amazon Web Services (AWS), its cloud-computing unit. In the past four years, Amazon shares have consistently fallen during the week of the two-day sale, whereas earlier years saw a gain of over 2% on average during this period. The shifting focus towards cloud computing is a result of AWS becoming the main source of operating income for the company, and investor interest in the potential of artificial intelligence (AI) applications.

Eric Clark, portfolio manager at Accuvest Global Advisors, notes that most investors previously looked at both Amazon’s e-commerce and AWS growth potential. However, with AI becoming a ubiquitous topic, the AWS opportunity and its potential AI implications have become more attractive. As the conversation surrounding AI continues to grow, investors are increasingly scrutinizing which companies stand to benefit the most from the AI revolution.

Prime Day Revenue and Growth Slowdown

Prime Day, which is set to begin this year, is projected to generate about $5 billion in incremental revenue, a 13% increase from last year. However, the pace of growth has steadily declined each year since experiencing a 30% increase in 2020. While Amazon’s retail business accounted for nearly two-thirds of sales last year, it was the faster-growing AWS unit that drove all of the company’s $12.2 billion in operating profit.

Although AWS experienced a record low in growth during the first quarter, analysts remain optimistic that the demand for generative AI applications will revitalize sales. This optimism stems from Amazon’s introduction of generative AI technology for cloud customers and its investment of $100 million to help customers develop and deploy new AI products. These endeavors position Amazon to compete with cloud computing units of Microsoft Corp. and Alphabet Inc.

The Future Lies in AI and AWS

Sylvia Jablonski, co-founder and chief investment officer at Defiance ETFs, sees Prime Day as an opportunity not only to capture sales but also to attract new customers to Amazon Web Services. However, she emphasizes that the future for Amazon lies in AWS and its participation in the innovation and growth of AI. With the rising significance of AI in various industries, companies like Amazon that have significant investments in cloud computing and AI technology are likely to gain a competitive edge.

Tech Chart of the Day

New Highs for Tech Stocks Amid AI Frenzy

Technology stocks, fueled by the investor frenzy over artificial intelligence, have experienced significant growth, with approximately a quarter of Nasdaq 100 companies reaching all-time highs this year. Data compiled by Bloomberg indicates that around 90% of tech companies on the Nasdaq 100 have achieved new records since 2021. However, some tech giants from the dotcom era, such as Intel Corp. and Cisco Systems Inc., have yet to fully recover losses from the subsequent crash.

The Nasdaq 100 index, which has already rallied 37% this year, remained relatively unchanged on Monday. This data demonstrates the ongoing bullish sentiment towards technology stocks and indicates the potential for further growth in the tech sector as AI applications continue to drive innovation.

Conclusion and Editorial

The shift in investor focus from e-commerce to the growth potential of AWS and AI applications is a reflection of the evolving landscape of the technology sector. Amazon Prime Day, once a significant catalyst for the company’s stock, now takes a backseat to the ever-expanding cloud computing and AI market.

While Amazon continues to experience revenue growth during Prime Day, it is the AWS unit that generates the majority of the company’s operating profit and is poised for future growth through the adoption of generative AI applications. As AI becomes increasingly integrated into various industries, companies like Amazon that have invested in cloud computing and AI technology are well-positioned to benefit from the ongoing AI revolution.

Investors should consider the long-term potential of companies like Amazon that have a strong foothold in the cloud computing and AI market. As the demand for AI applications and infrastructure continues to rise, the growth potential for these companies appears promising.

It is important for investors to diversify their portfolios and carefully assess companies’ strategies and investments in the technology sector. While Amazon remains a dominant player, other technology companies focused on AI and cloud computing should also be considered as part of a well-rounded investment strategy.

Overall, the shift in investor focus from e-commerce to AWS and AI indicates the changing landscape of the technology industry. Companies that can effectively leverage these emerging technologies are well-positioned for long-term success.

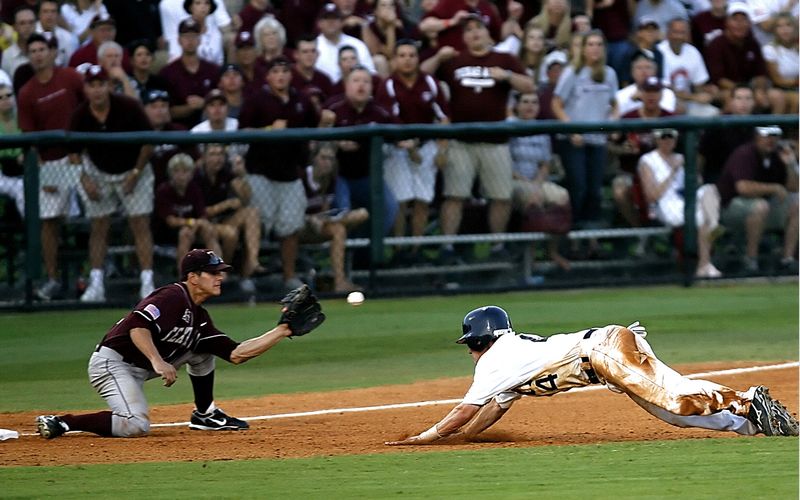

<< photo by Heamosoo Kim >>

The image is for illustrative purposes only and does not depict the actual situation.